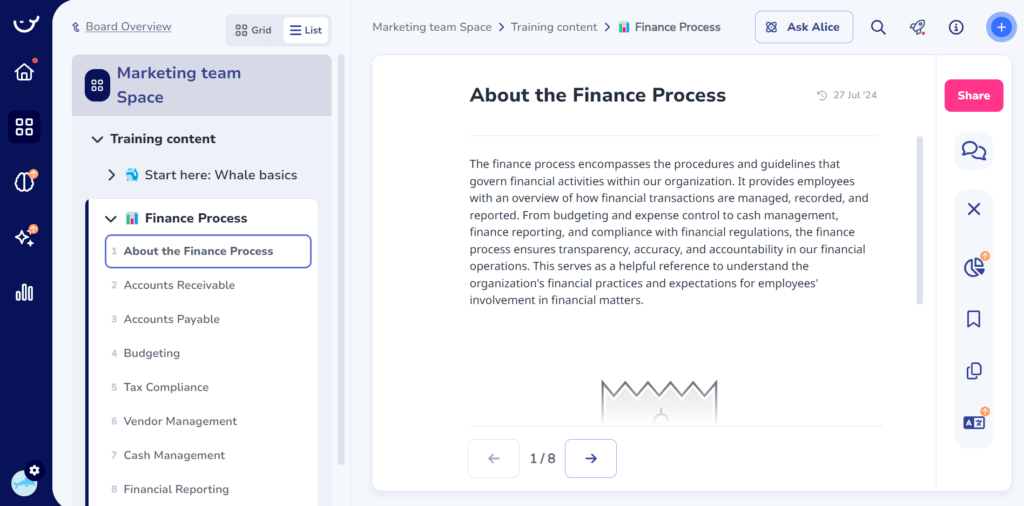

About the Finance Process

💡 The EOS® finance process encompasses the procedures and guidelines that govern financial activities within our organization. It provides employees with an overview of how financial transactions are managed, recorded, and reported.

From budgeting and expense control to cash management, finance reporting, and compliance with financial regulations, the finance process ensures transparency, accuracy, and accountability in our financial operations.

This section of the employee handbook serves as a helpful reference to understand the organization’s financial practices and expectations for employees’ involvement in financial matters.

Accounts Receivable

Invoicing: Include necessary information like invoice number, customer details, itemized descriptions, quantities, prices, and payment terms.

Payment Receipt: Match incoming payments to invoices and update the accounts receivable ledger. Verify payment details such as amount, method, and date received.

Reconciliation: Regularly reconcile customer accounts by comparing accounts receivable balances with customer statements. Identify and resolve discrepancies.

Collections: Monitor and follow up on overdue payments. Send reminders, make collection calls, or initiate collection activities when necessary.

Reporting and Analysis: Generate regular reports on accounts receivable to track outstanding balances, invoice aging, and overall cash flow. Analyze data to identify payment trends and potential risks.

Accounts Payable

Invoice Verification: Verify incoming invoices for accuracy and legitimacy. Ensure they include vendor details, description of goods/services, quantities, prices, and payment terms.

Recording and Coding: Record invoices in the accounts payable ledger, assigning appropriate expense codes or account numbers.

Approval and Authorization: Obtain necessary approvals for payment according to the organization’s approval process.

Payment Processing: Execute payments to vendors based on approved invoices. Adhere to agreed-upon payment terms and take advantage of any discounts for early payments.

Reconciliation: Regularly reconcile vendor statements with the accounts payable ledger. Address any discrepancies with vendors promptly.

Budgeting

Gather Financial Data: Collect historical financial data, including revenue, expenses, and other relevant information. Analyze trends to understand past performance.

Set Financial Goals: Determine financial goals for the upcoming period, such as revenue targets and expense reduction targets, aligning with organizational strategy.

Estimate Revenue: Forecast expected revenue based on historical data, market trends, and sales projections.

Project Expenses: Estimate anticipated expenses, including fixed costs (rent, utilities) and variable costs (salaries, marketing expenses). Monitor and adjust the budget as needed.

Tax Compliance

Gather and Organize Financial Data: Collect necessary financial documents such as income statements, expense records, and payroll information.

Determine Tax Obligations: Identify applicable tax obligations, including income tax, payroll tax, and sales tax. Understand filing deadlines and payment schedules.

Prepare and Calculate Taxes: Use gathered financial data to prepare and calculate taxes owed, ensuring accuracy and compliance with tax laws.

Complete and File Tax Returns: Fill out necessary tax forms accurately and submit them to tax authorities. Make timely tax payments and keep records for future reference.

Vendor Management

Vendor Selection: Evaluate potential vendors based on quality, pricing, reliability, and ability to meet organizational needs.

Contract Negotiation: Negotiate contract terms with selected vendors, including pricing, payment terms, and delivery schedules.

Vendor Onboarding: Gather necessary documentation from vendors and provide guidelines, policies, and procedures.

Performance Monitoring: Evaluate vendor performance based on product quality, delivery timelines, and customer service. Address any issues promptly.

Relationship Management: Maintain regular communication and engagement with vendors, fostering collaboration and mutual understanding.

integrify.com on How to Write Process Documentation

Use our templates to fast-track your documentation

Customize this template and 100s of others for free in Whale, the fastest way to get your team aligned.

Cash Management

Cash Flow Forecasting: Develop a forecast to project future cash inflows and outflows. Analyze historical data and current financial conditions.

Budgeting and Expense Control: Monitor expenses to ensure they stay within budget. Implement cost management strategies and identify potential savings.

Receivables and Payables Management: Promptly invoice customers and follow up on overdue payments. Negotiate favorable payment terms with vendors.

Cash Reserve and Liquidity Management: Maintain appropriate cash reserves for operational needs and unexpected expenses.

Regular Cash Monitoring and Reporting: Use cash management tools to track transactions and generate cash flow reports for analysis.

Financial Reporting

Financial Statement Preparation: Prepare necessary financial statements, including income statements, balance sheets, and cash flow statements, ensuring compliance with accounting standards.

Key Performance Indicators (KPIs) Identification: Identify KPIs relevant to the organization’s financial goals, such as revenue growth and profitability ratios.

Report Generation: Generate comprehensive finance reports with financial statements and KPIs for stakeholders.

Distribution and Presentation: Distribute finance reports to stakeholders and present key findings and insights during meetings.

FAQs on Financial Process Documentation Template

How do you write a process document?

To write a process document, first identify and name the process clearly. Define its start and end points, list the expected outcomes, and detail necessary inputs. Then, perform the process step-by-step to ensure completeness and note who is involved. Record all this information in your documentation system and review it thoroughly.

Process documentation captures the steps of a task as it happens, aiding in process improvement, reducing confusion, preserving knowledge, and enabling analysis. It ensures tasks are done consistently and efficiently, making it essential for business success and adaptability.

What is an example of a process flow document?

A family recipe is a non-business example, illustrating how process documentation streamlines tasks and enhances outcomes. These documents should be easily accessible to employees in a central location.

What’s the difference between process documentation vs. process mapping?

Process documentation and process mapping differ in their presentation.

Process documentation is a written guide detailing each step of a process, sometimes with some visuals.

Process mapping focuses on creating a visual diagram of the process, showing each step and how they connect, making it easier to see the overall flow.

How to organize process documents?

Alternatively, organize by task frequency, grouping processes based on how often they occur, such as weekly, monthly, or annually. This prevents too many main folders but may reduce high-level visibility since processes are first sorted by frequency.

How to improve process documentation?

- Be Clear and Concise: Write in a straightforward, conversational tone. Avoid jargon unless necessary and keep instructions easy to understand.

- Use Templates: Standardize documentation with templates to ensure consistency and reduce errors. Templates help maintain uniformity and save time.

- Incorporate Visuals: Use diagrams, flowcharts, videos, and other multimedia to make complex information easier to understand and retain.

- Link Related Documents: Connect documents to relevant information for quick access and enhanced efficiency.

- Regular Updates: Review and revise documentation frequently to keep it accurate. Establish a schedule for updates and control who can make edits.

- Prioritize and Segment: Focus on important processes first and create separate documents for different processes to avoid confusion.

- Involve Stakeholders: Engage stakeholders by identifying their interests, setting expectations, and incorporating their feedback into the documentation.

- Ensure Accessibility: Use a centralized, cloud-based repository for easy access and sharing. Prioritize security to protect sensitive information.

- Backup and Security: Implement robust security measures and maintain backups to safeguard your documentation.

- Use Documentation Tools: Leverage cloud-based tools to automate and simplify the documentation process, ensuring seamless integration and proactive updates.

Use our templates to fast-track your documentation

Customize this template and 100s of others for free in Whale, the fastest way to get your team aligned.